Know in detail about the E Way Bill Process

What is an E-way Bill?

E-way Bill or an electronic way bill is required for a person or entity registered with the GST portal to transport goods valued at more than Rs. 50,000 from one state to another. The E-way Bill system was introduced on April 1st, 2018 as a part of the rollout of the Goods and Services Tax (GST) regulation. With the E-way Bill system, a person needs to generate an E-way Bill from the GST portal if he/she desires to transport a consignment valued at over Rs. 50,000 across state borders. In January 2020, further changes were introduced to the E-way Bill system under which a person who has not filed their GST returns for two consecutive quarters will find the E-way Bill generation facility blocked until they file their pending returns.

Benefits of the E-way Bill System

1. Business owners no longer need to visit tax offices for matters related to transportation.

2. No more long queues of trucks at traffic check posts as E-way Bill ensures that transport related documents are processed online..

3. With online processing of documents, there is now increased transparency in the logistics and transportation process and a concomitant reduction in malpractices..

4. The E-way Bill has led to stricter compliance with GST collection and hence increased tax revenue for the state that in the longer run leads to greater public goods.

Who Needs an E-Way Bill?

An E-way Bill needs to be generated by a business or individual registered on the GST portal irrespective of whether they are a supplier or a receiver. Businesses at the end of the day depend on the movement of goods and materials, which makes shoring up the logistics supply chain critical for any business. Since transport and logistics can typically require large investments, you can make use of business loans of up to Rs. 35 Lakhs offered by Finserv MARKETS that help you shore up your logistics supply chain. Business loans by Finserv MARKETS come with minimal documentation and nominal interest rates to help you quick;y scale up your transportation and logistics to meet your growing business needs

How Can an E-way Bill be Generated?

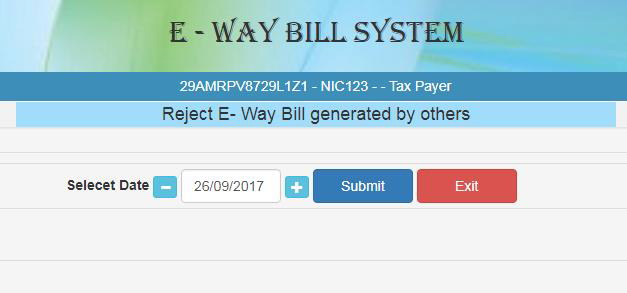

E-way Bill can be generated through the following steps:

1. Log on to the E-way Bill portal and enter your credentials.

2. Click on the Generate New tab from the E-way Bill main menu.

3. Fill in the transaction details depending on whether the movement of goods is “outward” or “inward”. If you are a supplier, the movement of goods in your case would be outward, and if you are a receiver, it would be inward.

4. Enter the description of the goods, their quantity, value, and the product name as mentioned in your tax invoice. You will also need to enter the distance to the destination as well as the HSN code for the goods. HSN stands for Harmonised System of Nomenclature that gives a code to over 5000+ items used in commerce.

5. Finally, click on submit to generate E-way Bill

What If I Get an Error When Submitting an E-way Bill?

Sometimes users may encounter errors while generating their E-way Bill. These may be due to a number of reasons such as:

- correct details not uploaded

- vehicle number not entered in the prescribed format

- multiple invoices uploaded for the same consignment

- incorrect log-in credentials, etc.

A complete list of errors during E-way Bill submission can be seen in this E-way Bill error code list.

Conclusion

The E-way Bill system offers many benefits to business owners such as reduced transportation time, streamlining of the logistics and transport pipeline, reduced paperwork and documentation, etc. To make the most of the E-Way Bill system, users should familiarize themselves with the process of E-way Bill generation.

0 comments