What do you mean by Robo Advisor?

There are different ways of investing in the present era. You can find multiple options once you look around. Do you know about robo Advisor? You know it is a new type of online software that has emerged. It can help you manage your investments. These software items are known as robo advisors.

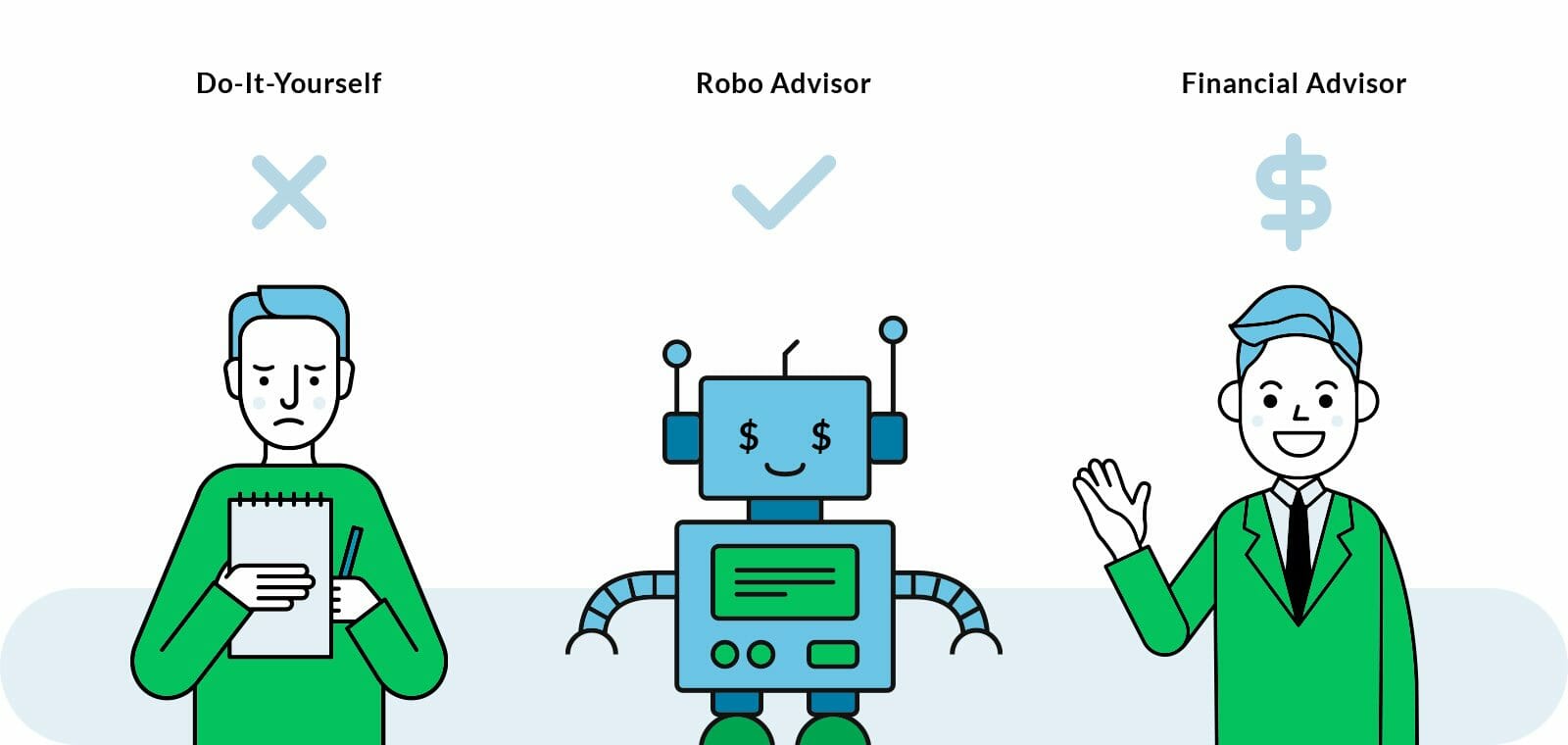

Once you look into the options you can get the Best robo advisor for your investments. it is true that a robo advisor could be a great solution for someone who does not wish to hire a financial advisor, does not have enough assets to recruit a financial advisor yet, or for a person who has characteristically been a do-it-yourself investor, but no longer wishes to select investments, rebalance, and even place trades on their accounts.

Robo advisors can automatically choose investments and construct a diversified portfolio for you. Once your funds get invested, on an ongoing basis, this software automatically makes the changes to the investments to bring into line your portfolio back to a target allocation. Some of the robo advisors even make trades automatically to assist in reducing your tax bill: a procedure known as tax-loss harvesting. In case you area do-it-yourself investor, then these low-cost online robo advisors could help you build a better portfolio.

What types of charges Are Involved?

With a robo advisor, you have to pay a service fee and you pay the expenditures of the investments used. Every single robo advisor has a reasonable service fee that could be structured as a fixed monthly charge or as that of a percentage of assets. With robo advisors that asks for a fixed monthly fee, the charges typically range from nearly $15 per month to that of $200 per month relying on portfolio size. With a percentage of assets structure, you are going to see fees in the range of around .15% to that of .50% of the account size per year.

You also have to pay any expenses linked with the investments used by the robo advisors. For example, mutual funds and that of exchange-traded funds have expenditure ratios. That kind of fee is taken out of the possessions of the fund before any type of returns is allocated to investors. Many of the online portfolio solutions cater to a free trial period so you can easily see how it works before you get charged.

Clear benefit

One of the hugest benefits of using a robo advisor is that you can avoid costly investing mistakes. It has been recognized many times over that one of the hugest reasons investors get poor outcomes is because of their own behavior. Investors end up making emotional decisions at market highs and market lows and based on gut feelings. And you know that software does not make any of these kinds of mistakes. Once there would be no mistakes or any stupid bloopers on the part of robo, you would not have to experience any loss.

Conclusion

Thus, you should dig in the world of robo advisor and it might suit your needs!

0 comments