Why Do You Need an RSI Indicator

There are a few reasons you may need an RSi indicator. In this post, we will go over the basics of RSI indicators and what you need to know in order to use them effectively.

The Different Types of Technical Indicators

There are three main types of technical indicators: trend, momentum and range. Trend indicators show whether a security’s price is rising or falling, while momentum indicators measure the speed at which prices are changing. Range indicators show the size of a security’s price swings.

Top 6 Technical Indicators Used in Trading

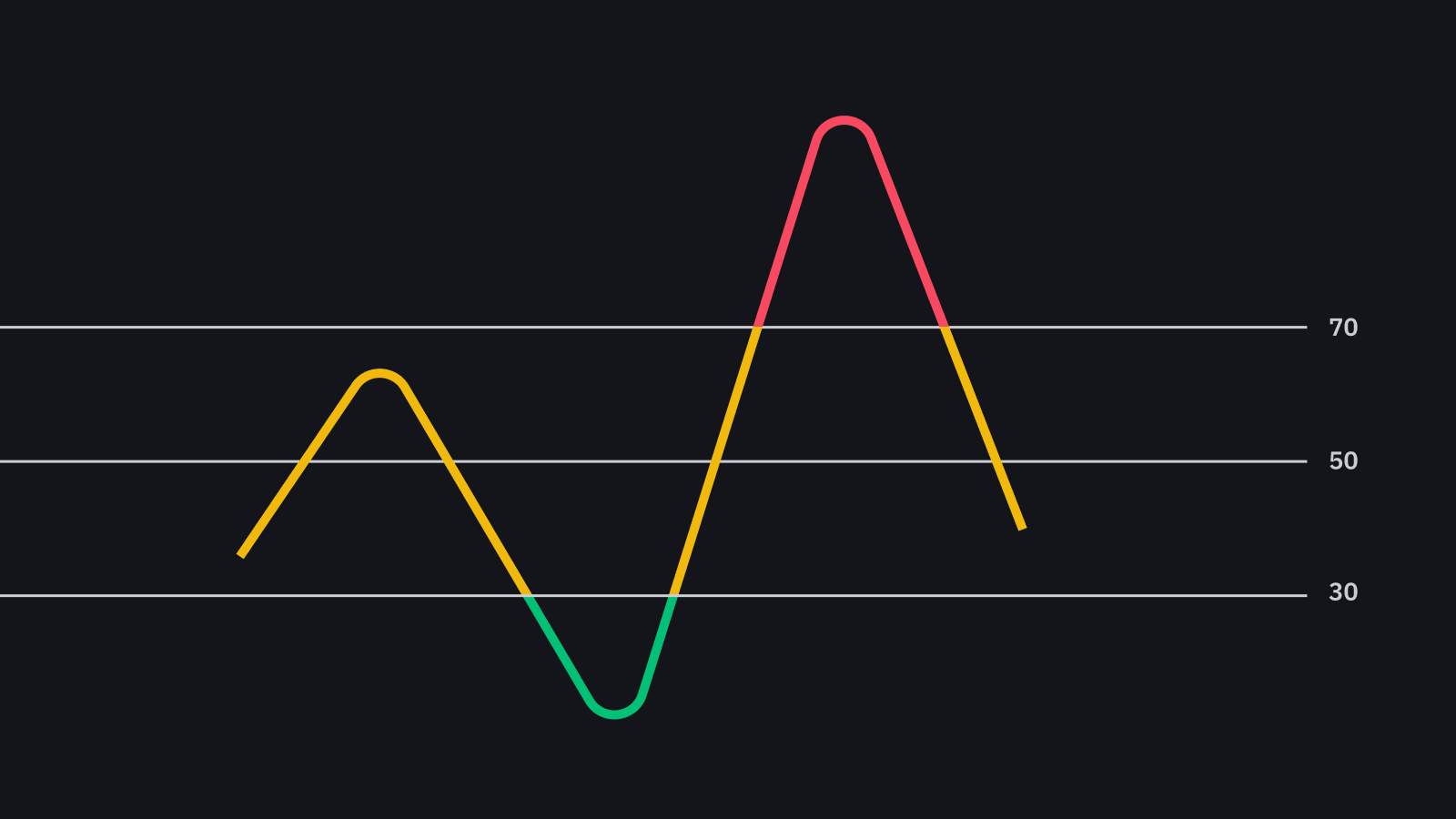

- The Relative Strength Index (RSI) is a popular trend-following technical indicator that oscillates between 0 (inverse direction) and 100 (strong trend). A stock with an RSI above 70 indicates that the security is overbought while an RSI below 30 indicates that it is oversold.

- The ADX is an indicator used to detect uptrends and downtrends in markets. It ranges from 0 to 25, with values below 20 indicating a weak trend and values above 25 indicating a strong trend.

- The stochastic oscillator is used to measure the strength of a trend and is plotted on a graph as a Moving Average Convergence/Divergence (MACD) indicator. When the MACD crosses over the zero line, this indicates that the trend is beginning to reverse.

- The ATR is a technical indicator that is used to measure the strength of a trend. It ranges from 0 to 1, with values above 0 indicating a strong trend and values below 1 indicating a weak trend.

- The Fibonacci Retracement is used to identify areas of price action where the price has retraced its most recent up or down move back to previous support or resistance levels, respectively.

- MACD – The MACD, or Moving Average Convergence Divergence, is a technical indicator used to measure momentum in the market. The indicator consists of two lines – a blue line that reflects the buying behavior of buyers, and a red line that reflects the selling behavior of sellers. If the blue line is above the red line, this signals that buyers are more active than sellers and prices are moving higher; conversely, if the red line is above the blue line, this signals that sellers are more active than buyers and prices are moving lower.

What is an RSI Indicator?

RSI is a technical analysis indicator that is used to measure the strength of a trend. The indicator ranges from 0 to 100 and indicates whether the market is overbought or oversold.

What is the Role of an RSi Indicator in Investment Returns?

An RSI indicator is used to measure the strength of a stock’s momentum. Momentum is generally considered to be a positive predictor of future returns. When the RSI is above 70, it is considered to be in overbought territory, and when it falls below 30, it is considered to be in oversold territory.

An Rsi indicator can play a role in investment returns by helping to indicate how well a company is managing its finances. By reading an rsi indicator, investors can get a better idea of a company’s financial stability.

Tips When Using RSI Indicator

When using the RSI indicator, traders should keep in mind a few tips to ensure accuracy. First and foremost, traders should use the indicator as a guide, not as gospel. Secondly, traders should always look at the chart in its entirety before making any decisions. Finally, traders should be cognizant of the RSI’s “line of balance.” This means that if the RSI is close to the line of balance (indicating oversold conditions), then it is important to sell stocks accordingly. Conversely, if the RSI is close to the line of support (indicating overbought conditions), then it is important to buy stocks.

Conclusion

An RSI indicator is a valuable tool that can help investors to better understand a company’s overall health. By reading an RSI indicator, investors can get a better understanding of a company’s financial stability and its ability to fund future growth